What is IPO & How does IPO Works in India?

IPO is an initial public offering in which the private companies go public with the security offering to the public. The companies file the draft papers aka DRHP to SEBI and after the approval, the company files RHP and final documents with the IPO launch date and required information.

The companies can raise equity capital by coming up with an IPO by issuing new equity shares to the public or the existing shareholders can sell their shares to the public without raising any fresh capital. The IPO comprises Fresh Issue and the Offer for Sale. IPO is the way the company lists its shares on the primary market/stock exchanges.

How & Who decides the Price Band in IPO?

The IPO lead managers (merchant bankers or syndicate members) decide the price or price band of an IPO. After the final process, the SEBI validates the content submitted via IPO Prospectus.

What is the difference between IPO Cut-off Price & Floor Price?

In the Book Building Public Issue (IPO) price band the minimum bid price is called Floor Price while the cut-off price is where the investors are ready to get the shares as per the company’s decided price.

If the price band of the IPO is set around between Rs. 90-100. The Floor Price of IPO is Rs.90 and the maximum cut-off price will be Rs.100. If the company decides to set the IPO price at Rs.95 the cut-off price will be Rs.95 for the investors who applied via cut-off price.

What is the difference between Fresh Issue & Offer for Sale?

In the Fresh Issue, the company issues new equity shares and raises the capital from the investors via IPO while Offer for Sale is the equity already issued to the promoters of the company and sells it via IPO.

Who decided on the IPO Dates?

After the approval of DRHP, the company discussed with the lead managers and merchant bankers to decide the final IPO dates.

What is the role of the IPO Registrar?

The IPO registrar does the process of an IPO. They are SEBI Registered and the company should appoint a registrar to go public. They are doing the process of collecting IPO applications and the allocations of the shares to the investors of different categories as per the SEBI guidelines. They also process the refunds of the non-allottees to their bank accounts and transfer the allotted shares in the respective Demat accounts that got the allotment.

What is the role of IPO Lead Managers?

The companies appoint lead managers to process the IPO. They mainly draft the prospectus, get approval from SEBI, decide the price band and the IPO date, and help companies to list on the stock market. There might be multiple lead managers as per the company’s IPO size.

What is the Primary & Secondary Market?

The primary market is the market where the investors buy the shares from the company offered via IPO.

A secondary market is a market where the trading starts after the listing of an IPO or we can say a platform where one can trade the listed equities.

What is the IPO Prospectus Life Cycle?

The company that wants to go public, they file the draft red herring prospectus aka DRHP with SEBI with help of lead managers. The DRHP includes information about the company, business details, management, risk of applying the issue, company finances, and more. The SEBI reviews the PDF document and shares the changes if required. After the final review, the SEBI approves the DRHP and gives go-ahead for an IPO. The documents are available on SEBI’s website under section Filings > Public Issues > Draft Offer Documents filed with SEBI.

Once the draft red herring prospectus aka DRHP cleared by the SEBI, now it becomes the offer document. It is the modified version of the DRHP.

After clearance of the Offer Document from the SEBI, the company adds details like issue size, date, price band to the document. This is called Red Herring Prospectus. The documents are available on SEBI’s website under section Filings > Public Issues > Red Herring Documents filed with ROC.

What is DRHP?

The company that wants to go public, they file the draft red herring prospectus aka DRHP with SEBI with help of lead managers. The DRHP includes information about the company, business details, management, risk of applying the issue, company finances, and more. The SEBI reviews the PDF document and shares the changes if required. After the final review, the SEBI approves the DRHP and gives go-ahead for an IPO. The documents are available on SEBI’s website under section Reports > Public Issues: Draft Offer Documents filed with SEBI.

What is RHP?

After clearance of the Offer Document from the SEBI, the company adds details like issue size, date, price band to the document. This is called Red Herring Prospectus. The documents are available on SEBI’s website under section Filings > Public Issues > Red Herring Documents filed with ROC.

Do you need a Demat Account to apply for an IPO?

Yes, an investor who needs to Apply for IPO should have a Demat account number either from NSDL or CDSL.

What is DP Name in IPO Online Form?

DP Name is the name of the company from which the investor opened a Demat account. If one opened a Demat account via ICICI Securities, one should fill the same in the box against DP Name.

Is PAN Card Mandatory to Apply for an IPO?

After 2006, SEBI made PAN Card mandatory for IPO applicants. If one applies for the IPO without a PAN card or the wrong PAN card, it is considered faulty.

Can I apply for multiple IPO Applications on a Single PAN Card?

No, one person can apply for only one IPO application. Multiple IPO applications via a single PAN card, same name, or same Demat account will be rejected.

How many IPO Applications via one PAN Number?

IPO applicants should be able to apply for one IPO from one PAN Number as per the rules.

How many IPO Applications can be made from One Bank Account?

The number of IPO applications that can be made from one bank account varies from bank to bank. The SBI Bank allows 5 IPO applications via one SBI bank account while ICICI Bank allows only 1 IPO application.

IPO investors can add up to 5 different Demat accounts in the SBI Bank Account to apply them via one bank account.

Is it possible to apply for an IPO via BHIM UPI?

SEBI permitted the UPI Id for IPO application. BHIM app will be one of the best options to apply for an IPO via UPI. It reduces the IPO application process.

Download the BHIM application and create a UPI ID or link the bank accounts. When one is applying for an IPO mention the UPI ID and then the mandate will be received on BHIM. Approve the mandate and the IPO application is successfully submitted in easy steps.

What is the difference between Book Building & Fixed Price?

Initial Public Offering can be made through the fixed price method, book building method or a combination of both. Difference between shares offered through book building and offer of shares through the normal public issue (Source: BSE)

What is the Difference Between RII, NII, QIB, Anchor Investors?

There are different categories in the IPO application.

RII – Retail Individual Investors: In this category, an applicant can apply below Rs.2 lakh of bids. The retail investors can be Indian residents, NRIs, or HUFs. The retail category should be 10% or 35% of the issue size as per the company prospectus. They can apply at a cut-off price.

NII- Non-Institutional Investors: In this category, an applicant can apply for more than Rs.2 lakh of bids. The NII investors can be Indian residents, NRIs. HUFs, companies, corporates, societies or trusts. The NII category should be 15% of the issue size as per the company prospectus.

QIB – Qualified Institutional Investors: The QIB investors can be public financial institutions, commercial banks, mutual funds, foreign portfolio managers, and more. The QIB category should be 50% to 75% of the issue size as per the company prospectus. As per the SEBI, the QIB’s won’t be able to withdraw their application. They are not eligible for cut-off price applications.

Anchor Investors: An anchor investor can apply for Rs.10 crores or more via the book-building process. They get a chance to subscribe to the before the IPO date to attract investors to public offerings. They get up to 60% of the QIB category allocation. They are not eligible for cut-off price applications.

As a Retailer How to Apply in NII Category?

A retailer who bids with more than Rs.2 lakhs falls into the NII category. The retail investor can apply either in the Retail or NII category.

How many days does the IPO Open?

As per the rules, the IPO remains open for 3 days or max 10 days (In case of price band revision or exceptions).

What is the Market Lot Size?

There are two types of market lot, minimum and maximum. The market Lot size is the term where the company fixed the number of shares for minimum IPO application. If an investor wants to apply more than that they can do it in the multiple market lot size.

The minimum lot size should be 1 and approx Rs.15000 and the maximum lot size should be 13 or 14 approx Rs.200000 for retail investors.

Is there any guarantee to get the IPO Application Success with Allotment?

No, as it’s a process there is no guarantee of getting the successful allotment of shares in the IPO. If the IPO subscribed below 1 time or 1x there will be a firm allotment chance otherwise it will be done on a lottery basis.

What is the Basis of Allotment?

The basis of allotment is the document the registrar publishes after the allotment process. It includes the final price and the share allotment ratio as per the subscription received. The basis of allotment is crucial when the IPO subscribed multiple times.

For example, if the bids are coming on a higher side and the IPO subscribed 10 times, the basis of allotment will be around 10:1. It means out of 10 applications 1 will get the allotment.

Should I do Multiple Applications for One IPO?

Yes, you can apply for the IPO via a different Demat Account with Different Names and Different PAN Numbers. You can apply for an IPO via ASBA, UPI, or Offline Forms as well.

How to Cancel the IPO Application?

The IPO application can reverse the bid they applied for, they need to fill out a revision form and give it to syndicate members. The IPO application cancellation should be done at the time of the IPO subscription. After the closure, one can not cancel the IPO application.

Can a Minor Apply in an IPO?

Some companies allow the Minor IPO Application. If one has a Demat account of his son and his own, he will be able to apply via only 1 Demat account as a guardian in a minor account or as a retailer. If one applies in minor and retail both the application will be rejected.

How to Choose the Right IPO?

The company looks strong fundamentals, strong financial results and is highly demanded. The company has a good future and a strong background. The IPO Size, Price Band, and the promoter’s stake sale (OFS) should be checked before applying for an IPO.

How many Ways to Apply for an IPO?

One can apply for an IPO via ASBA (Bank), UPI, or Offline Forms.

What are the Risk Factors in an IPO?

There are a few risk factors in applying for an IPO. There is no guarantee of the share allotment in case of oversubscription. Sometimes IPO applications decline or some are not getting the mandate for approval. Sometimes the IPO application is rejected and the amount blocked. After the listing, the share might list below the IPO price so a chance of loss as well.

What are the minimum and maximum amounts for the retailer category in an IPO?

For the retail category, the minimum lot size should be 1 and approx Rs.15000, and the maximum lot size should be 13 or 14 approx Rs.200000 for retail investors. As per the new rules, the retailers can also apply in the NII category with applications above Rs.200000.

How to Withdraw an IPO Application?

One can withdraw the IPO application in between the bidding period. Go to Order, Select IPO and Withdraw. The fund will be released in 2 – 3 working days.

How to Sell on Listing Day? Should I be able to sell the allotted IPO shares on the listing?

On a listing day, NSE and BSE allow pre-opening sessions of 9 to 9:45 during which the order can be entered, modified, and canceled. One can go online or call a broker to sell the IPO on a listing day. As per the rules, the IPO share allottee gets the share in the Demat account before the listing day.

In which category a Private Limited Company can apply for an IPO?

A Private Limited Company can apply for IPO in the NII aka non-institutional category.

In which category a Private Family Trust can apply for an IPO?

A Private Family Trust can apply for IPO in the NII aka non-institutional category.

How many days does the IPO Listing take?

The listing and commencement of trading within six working days of the offer closing date.

How many days does the IPO Allotment take?

The IPO allotment within three to four working days of the offer closing date.

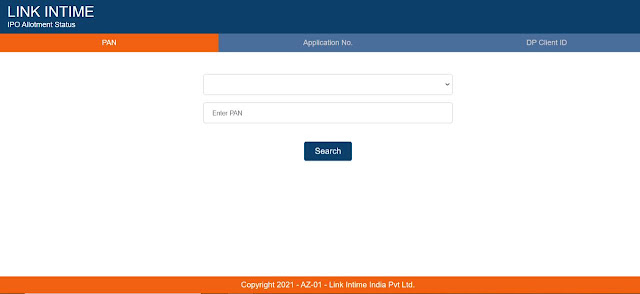

Where to check IPO Allotment Status?

One can check the IPO allotment status on the BSE Website or the IPO Registrar website as on the allotment date finalized by the company registrar.

What is the lock-in time period for Anchor Investors?

For anchor investors, the lock-in period is 30 days for 50% of the shares and 90 days for the remaining 50% of the shares.

What is the lock-in time period for HNI or NII?

The HNI or NII can sell their shares on a listing day. There is no lock-in period for HNI or NII category.

What is the lock-in time period for RII or Retailers?

The Retailers can sell their shares on a listing day. There is no lock-in period for the RII category.

Should I Apply for an IPO via my Current Account?

No, Most of the banks do not allow IPO Applications via Current Accounts.

How to apply for an IPO via HUF?

It’s as simple as a Retail application. One can apply for an IPO via a HUF account as the defined process. A HUF Karta can apply for 2 applications one via a HUF account and one via the retail category.

Should I apply for an IPO on the last day & Till What time should I Apply?

Yes, you can apply for the IPO on the last day but there is a time limit to do the bid. You can refer to the bank-wise timing for the ASBA applications. Some brokers stop the application around 12:00 PM. One can apply for an IPO till 5:00 PM as the IPO Bid time ends for retail categories. For QIB and NII category the IPO Bid timings end at 4:00 PM on the last day.

How to find IPO Subscription Status?

The IPO subscription status can be referred to on our portal on the particular IPO page or one can refer to the numbers on NSE and BSE website on the particular IPO.

How to apply for an IPO Offline?

Go to your stockbroker and take the physical IPO form. Fill up the details and submit the form to your bank or submit it to your broker. Some brokers are offering pre-filled forms as well.

How to apply for an IPO Online?

You can apply for an IPO Online via ASBA or via UPI.

If retailers apply in the NII category what is the process?

Select the NII category while applying for the IPO and bid for more than Rs.200000.

What is the circuit limit on the IPO listing day?

As per the market rules, there is a 20% circuit limit on the listing price for the B Category listing and a 5% circuit limit for the T Category listing.

If the IPO price band is Rs.100 and the IPO list at Rs.150 the circuit limit will be applied on the listing price of Rs.150. So the stock can go up to Rs.180 on a higher side and up to Rs.120 on a lower side.

Should I be able to apply for an IPO on Sunday?

If you are applying via ASBA it’s possible but if you are applying via UPI it won’t be possible.

How to sell an IPO?

You can call your broker to sell the IPO on a listing day or you can do it by yourself if you are using Zerodha, Upstox, PayTMMoney, or other broker services.

How to get updates on the upcoming IPO?

Log on to our Upcoming IPO Page where you will be able to find the current and upcoming IPO list with their date, price band, and issue size.

How is the IPO investment taxed or Is the Capital Tax Gain application on IPO?

Yes, it’s taxable. According to the Income Tax Act, if shares allotted in an IPO are sold within the holding period of 12 months, the realized gain or loss will be taxable as short-term capital gains or loss.

2 Responses

After allotment, how to know that we sale or wait for long time to hold the share.

please guide.

Good information